Mlps Look Attractive Again

- Airtight Finish Funds

Energy MLPs: Safe To Go Back Into The Pool?

Dec. 24, 2020 eleven:42 AM ET AMLP, CEN, FEI, FIF, FPL, KMF, MLPX, VDE, FEN, KYN 97 Comments 42 Likes

Summary

- Many of us got burned in the "double black swan" bear on on chief limited partnership funds (MLPs) final March when the global energy price state of war coincided with the COVID-19 crisis.

- Those that survived and refocused themselves may offer attractive opportunities, especially with relatively safe higher yields at attractive discounts harder to detect in the market these days.

- But perhaps not for the faint of heart.

- I plan to keep my positions relatively pocket-sized until we encounter how the economic system plays out in the next few quarters.

- This idea was discussed in more depth with members of my private investing customs, Within the Income Manufactory. Get started today »

Energy infrastructure primary express partnerships (MLPs) were the hardest hit of the various nugget classes that populate the closed-end fund globe, and I and my investment portfolio carry many scars from the experience.

All the same, I don't want to let bad judgments and/or bad luck from the by (undoubtedly a bit of both!) hinder my ability to accept advantage of opportunities that arise currently or in the future. So I accept been keeping an eye on the MLP sector of the closed-end fund market and believe there are some expert opportunities for those willing to dive back into that item terminate of the investing pool.

I have no present plans to add together MLP funds to any of our Inside the Income Manufactory model portfolios in the near future, but I'm serving them up as options for those who wish to add some additional spice to their portfolios, in terms of slightly higher yields and potential capital gains as the underlying assets better and/or the funds' currently wide discounts eventually contract a bit.

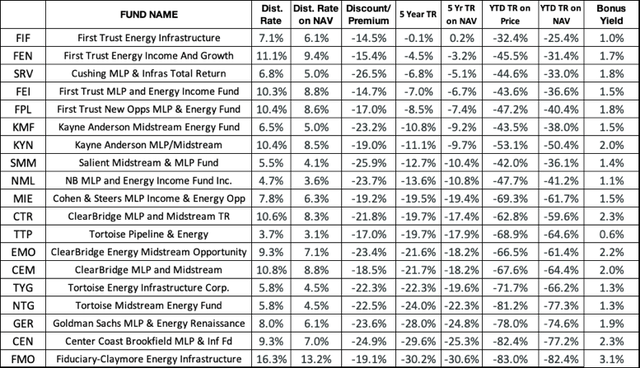

Hither is the current list of MLP funds, per CEF Connect, but with a few adjustments. If yous check any of these funds on CEF Connect, note that ii of them (KMF and CEN) were listed with distribution yields 3 times larger than they actually are, because they are still listed as monthly rather than quarterly. I corrected those ii on this listing.

I too updated the data from iv weeks agone, when I first presented this to our Within the Income Factory members. I think some of the opportunities are every fleck as compelling now equally they were back and then.

I ranked the funds by their average v-yr total returns, in order to have a baseline indicator of which have performed the best over what has been a challenging menses, fifty-fifty before the impact of terminal spring'south events. Interestingly, the five-yr results line up pretty closely with the yr-to-date results, and then either fashion we sort information technology, the rankings are much the same.

Then I focused on the one-half dozen or so funds that were at the top of that list (i.e. the smallest average losses), and that looked the most bonny in terms of both yields and loftier discounts.

The six funds that impressed me the virtually were all managed by 2 fund management firms: Outset Trust and Kayne Anderson.

- Kickoff Trust Energy Income & Growth (FEN) has the highest yield at 11.i% on its market toll, and 9.4% on its NAV, the big gap due to its -15.iv% disbelieve. With such a big gap between the market price yield and the NAV yield, FEN's "bonus yield" is 1.8%. That means investors can collect an above average 11.i% yield, simply because we have 15.4% more avails working for us than we have to pay for, we are merely taking the take a chance associated with a 9.4% yield. That'due south a big divergence in risk. FEN also gets kudos from other Seeking Alpha authors, like this one from Trapping Value, too equally others listed on FEN'southward summary page.

- First Trust MLP & Free energy Income Fund (FEI), a sibling to FEN, with a x.three% distribution yield, 8.8% yield on NAV, generous -14.7% discount, and bonus yield of 1.5%. Aforementioned managers, similar kudos from Seeking Alpha authors.

- First Trust New Opportunities MLP & Energy (FPL), with its 10.4% distribution yield (8.6% yield on NAV), extra generous -17% discount, and 1.8% bonus yield, also looks bonny and gets a good ship-off from other Seeking Alpha authors.

- Starting time Trust Energy Infrastructure (FIF) has a lower distribution (seven.1% on market price, 6.i% on NAV) and a very attractive discount of -14.5%. Its lower yield reflects its portfolio, which while split between natural gas transmission, petroleum product transmission, and electric power generation and transmission like its siblings, is incomparably tilted more than toward electric power than the other three. Electric utilities represent twoscore% of FIF's portfolio, vs. 25% of the other 3 funds. Some investors may prefer FIF's lower distribution yield rather than the higher ten%-xi% yields of its sibling funds, in order to take a slightly larger anchor weighting in the possibly more than predictable electric utility sector. Here's a link explaining this.

- All iv of these First Trust offerings look bonny, accept the same management squad and lots of overlap on their portfolios. I started out by buying some FEN considering it's got a higher yield and somewhat better total return history. FPL has a slightly bigger disbelieve, which may reflect that information technology'south a smaller fund in terms of marketplace capitalization which some investors may regard as greater liquidity take a chance.

- Kayne Anderson MLP Midstream (KYN) besides looks bonny, with its ten.four% distribution yield (eight.five% yield on NAV), and generous -19% discount. That'south a bonus yield of 2%. It'due south also far and away the largest, most liquid and widely traded of the MLP fund category. KYN is the other fund, besides FEN, that I currently ain, although I plan to buy FEI, FPL and perhaps FIF and KMF.

- Kayne Anderson'due south Midstream Energy Fund (KMF) looks interesting as well, with its 6.5% distribution yield and v% NAV yield and whopping -23.2% discount. Simply like the First Trust funds, the difference between the yields of these ii Kayne Anderson funds as well may exist explained by the fact that KMF holds only well-nigh l% midstream and the balance is utilities and other free energy companies, while KYN is 87% midstream and relatively few utilities and other free energy companies.

- Viable alternatives for investors who desire to go the ETF route instead of CEFs would be Global 10 MLP & Energy Infrastructure ETF (MLPX) and ALPS Alerian MLP ETF (AMLP). Here are recent write-ups on both: (MLPX article and AMLP article). I may purchase some MLPX in add-on to the funds listed.

Recently I suggested to Inside the Income Factory members that energy stocks and funds had been beaten downwards to a bespeak that they represented decent upside opportunities for those of usa who believe that our transition to a more climate friendly energy policy would be gradual and have many years. During that time the ameliorate managed traditional energy companies will probable remain in business concern, generate dividends and distributions, and - ultimately - participate in the new free energy technologies that will evolve.

When I fabricated my comments I was referring to the broader energy market, equally represented by the Vanguard Energy ETF (VDE). Simply I think information technology also applies to the energy transportation, storage and infrastructure providers, like the MLP funds invest in. So I see these funds equally playing a useful office in providing some college yields in my portfolio, although I plan to be cautious both with respect to how much I invest and how gradually I do so.

As always, I look forrard to your comments and questions!

Accept a happy holiday, and stay safety!

Steve

I startedInside the Income Manufactory because many of my 11,000+ followers asked for a more than frequent and personalized dialogue most the investment decisions that informed our Income Factory® model portfolios, my personal portfolios and other "candidate lists."

I startedInside the Income Manufactory because many of my 11,000+ followers asked for a more than frequent and personalized dialogue most the investment decisions that informed our Income Factory® model portfolios, my personal portfolios and other "candidate lists."

I read dozens of articles a calendar week, looking for ideas to share with members; as well answer member questions, whether or non they relate to funds in our portfolios.

Take your Income Manufacturing plant® investing up a notch. Pleaseclick here for a free trialof Inside the Income Factory. Want even more than background? Check out our book: The Income Factory (McGraw-Hill, 2020), bachelor on Amazon.

This commodity was written by

Existent-time insights and alerts on all our Income Mill™ model portfolios

Steven Bavaria is the writer of "The Income Factory: An Investor's Guide to Consistent Lifetime Returns" (McGraw Hill, 2020), and publishes a bazaar market service - Inside the Income Factory - here on Seeking Alpha. He introduced the Income Factory philosophy in his Seeking Alpha articles over the past 10 years. Bavaria writes well-nigh finance, economics and politics, drawing on his fifty years experience in international banking, credit, investment, journalism and public service. His earlier book "Also Greedy for Adam Smith: CEO Pay and the Demise of Capitalism" was inspired by his brief experience running the homo resource department at the Depository financial institution of Boston, where he first learned most the excesses in the CEO pay arena. The book is available on Amazon and at independent retailers. (Here is the link.)

Bavaria began his career at the Depository financial institution of Boston, where he handled international credit workouts that included managing a armada of ships, chasing a Vatican-owned banking company in Switzerland, and leading the turnaround of troubled branches in Australia and Panama, before returning to Boston to run the bank's human resources department.

After he worked at Standard & Poor'south, where he introduced ratings to the leveraged loan market. (Read about it hither.) In between Bank of Boston and S&P he was Assoc. Commissioner of the Massachusetts Dept. of Mental Health, worked briefly for Citibank, and was a reporter for IDD Mag. He also did a short stint at a smaller rating agency where he had to exit in a bustle after writing an commodity called "From Banker to Bookmaker" that was deemed as well candid in describing the conflicted office of major commercial and investment banks. (Read information technology here.)

Bavaria graduated from Georgetown Academy and New England School of Law. He lives in Ponte Vedra, Florida.

Disclosure: I am/we are long KYN, FEN, VDE. I wrote this commodity myself, and it expresses my own opinions. I am non receiving compensation for information technology (other than from Seeking Alpha). I have no account with whatever company whose stock is mentioned in this article.

Source: https://seekingalpha.com/article/4396133-energy-mlps-safe-to-go-back-pool

0 Response to "Mlps Look Attractive Again"

Post a Comment